Last active

February 27, 2025 16:56

-

-

Save 84adam/778354c2f41de3daafca2370557e0383 to your computer and use it in GitHub Desktop.

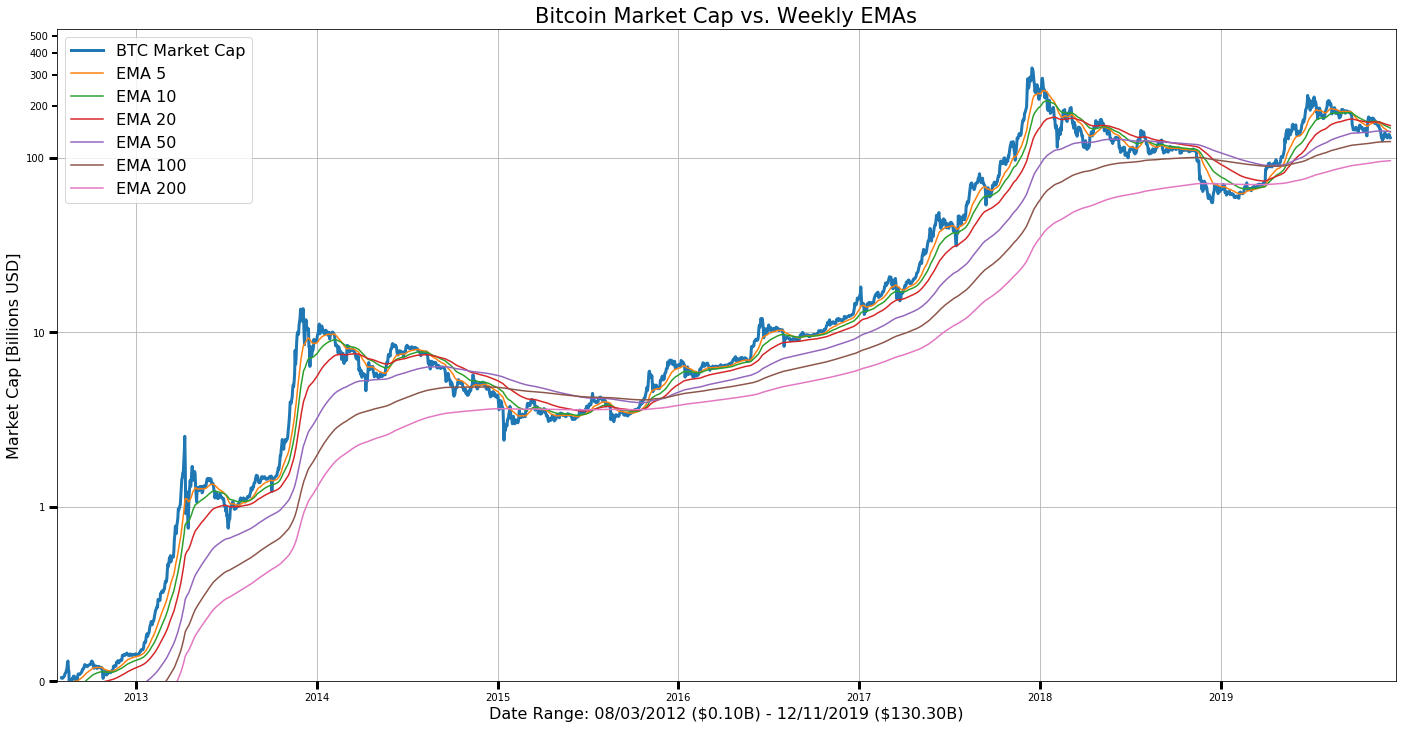

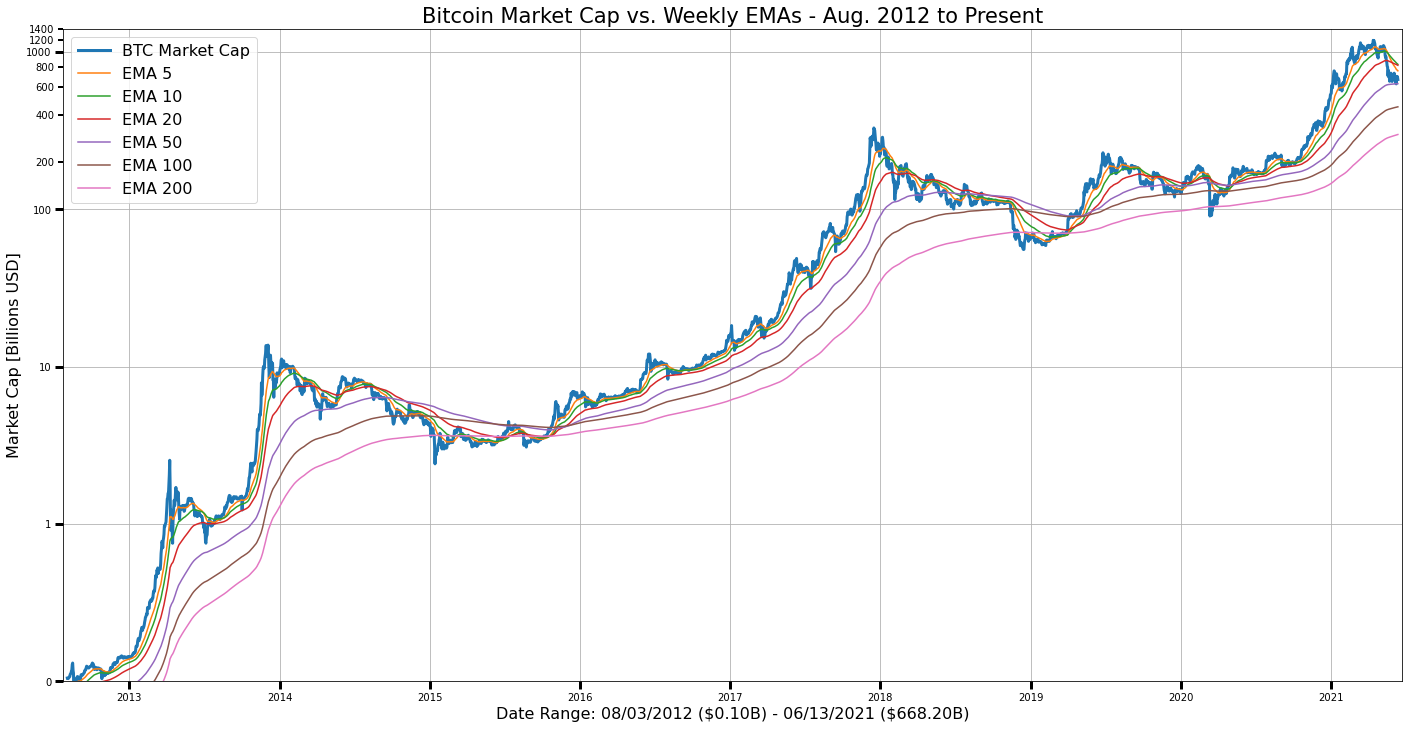

Plot BTC Market Cap Weekly EMAs

This file contains hidden or bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| import datetime as dt | |

| import requests | |

| import io | |

| import pandas as pd | |

| import matplotlib.pyplot as plt | |

| from matplotlib.pyplot import figure | |

| from matplotlib import ticker | |

| from matplotlib.ticker import (MultipleLocator, FormatStrFormatter, AutoMinorLocator) | |

| %matplotlib inline | |

| # function to download CSV file from URL; convert to Pandas DataFrame | |

| def get_csv_from_url(url): | |

| s = requests.get(url).content | |

| df = pd.read_csv(io.StringIO(s.decode('utf-8'))) | |

| return df | |

| if __name__ == '__main__': | |

| # data source: coinmetrics.io - all BTC community data (CSV) | |

| url = "https://coinmetrics.io/newdata/btc.csv" | |

| # download data | |

| print("Downloading data...") | |

| df = get_csv_from_url(url) | |

| # select columns | |

| df = df[['time', 'CapMrktCurUSD']] | |

| # rename columns | |

| df = df.rename(columns={"CapMrktCurUSD": "market cap"}) | |

| # convert 'time' (object series) to timestamp format | |

| df['time'] = df['time'].astype('datetime64[ns]') | |

| # divide market cap by 1 billion | |

| df['market cap'] = df['market cap'] / 1000000000 | |

| # rename for convenience | |

| x = df['time'] | |

| y = df['market cap'] | |

| # calculate Exponential Moving Averages (EMAs) [Periods: 5, 10, 20, 50, 100, 200] | |

| # enter (#-days) per period for EMAs, e.g. '7' = 1 week/period | |

| per = 7 # one week | |

| df['EMA_5p'] = df.iloc[:,1].ewm(span=(5*per),adjust=True).mean() | |

| df['EMA_10p'] = df.iloc[:,1].ewm(span=(10*per),adjust=True).mean() | |

| df['EMA_20p'] = df.iloc[:,1].ewm(span=(20*per),adjust=True).mean() | |

| df['EMA_50p'] = df.iloc[:,1].ewm(span=(50*per),adjust=True).mean() | |

| df['EMA_100p'] = df.iloc[:,1].ewm(span=(100*per),adjust=True).mean() | |

| df['EMA_200p'] = df.iloc[:,1].ewm(span=(200*per),adjust=True).mean() | |

| # rename for convenience | |

| y5 = df['EMA_5p'] | |

| y20 = df['EMA_20p'] | |

| y10 = df['EMA_10p'] | |

| y50 = df['EMA_50p'] | |

| y100 = df['EMA_100p'] | |

| y200 = df['EMA_200p'] | |

| # set starting and ending dates | |

| # start = len(df['time']) - (365*1+1) # one year ago | |

| # start = len(df['time']) - (365*2+1) # two years ago | |

| # start = len(df['time']) - (365*3+1) # three years ago | |

| start = 1308 # market cap >= $100M from this date onwards: '2012-08-03' | |

| end = len(x) - 1 # last date in series | |

| start_date = df['time'][start] | |

| end_date = df['time'][end] | |

| # get start/end market cap values (Billions USD) | |

| start_mc = y[start] | |

| end_mc = y[end - 1] | |

| # set ranges for plotting on chart | |

| x = x[start:end] | |

| y = y[start:end] | |

| y5 = y5[start:end] | |

| y10 = y10[start:end] | |

| y20 = y20[start:end] | |

| y50 = y50[start:end] | |

| y100 = y100[start:end] | |

| y200 = y200[start:end] | |

| # set figure size | |

| plt.figure(figsize=[24,12]) | |

| ax = plt.subplot(1, 1, 1) | |

| # plot values in log scale | |

| ax.semilogy(x, y, label='BTC Market Cap', linewidth=3) | |

| ax.plot(x, y5, label='EMA 5') | |

| ax.plot(x, y10, label='EMA 10') | |

| ax.plot(x, y20, label='EMA 20') | |

| ax.plot(x, y50, label='EMA 50') | |

| ax.plot(x, y100, label='EMA 100') | |

| ax.plot(x, y200, label='EMA 200') | |

| # set y-scale limits: $100 million to $1.4 trillion | |

| ax.set_ylim(0.1, 1400) | |

| # ax.set_ylim(50, 300) | |

| # set x-scale limits: | |

| # start/end dates 10 days before/after specified `start_date`/`end_date` | |

| ax.set_xlim(start_date - dt.timedelta(days=10), end_date + dt.timedelta(days=10)) | |

| # ax.set_xlim(start_date - dt.timedelta(days=5), end_date + dt.timedelta(days=5)) | |

| # set Y-axis tick formats | |

| ax.yaxis.set_major_formatter(ticker.FormatStrFormatter('%.0f')) | |

| ax.yaxis.set_minor_formatter(ticker.FormatStrFormatter('%.0f')) | |

| ax.tick_params(which='major', width=3, length=8) | |

| ax.tick_params(which='minor', width=2, length=5) | |

| # for the minor ticks, show only every 100 billion mark | |

| ax.yaxis.set_minor_locator(MultipleLocator(200)) | |

| plt.grid(True) | |

| plt.legend(loc=2, fontsize=16) | |

| plt.xlabel(f'Date Range: {start_date.strftime("%m/%d/%Y")} (\${start_mc:.2f}B) - {end_date.strftime("%m/%d/%Y")} (\${end_mc:.2f}B)', fontsize=16) | |

| plt.ylabel('Market Cap [Billions USD]', fontsize=16) | |

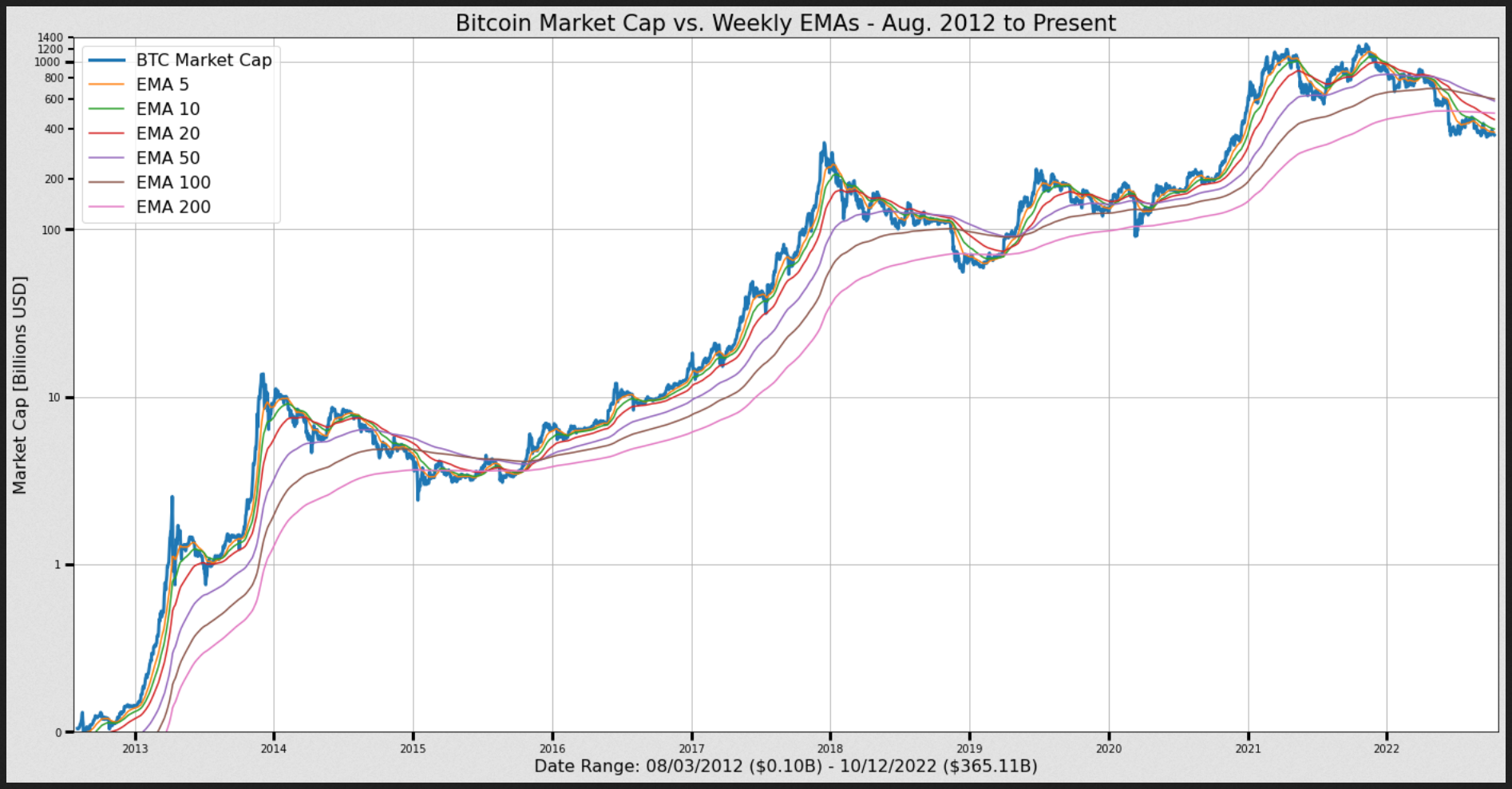

| plt.title("Bitcoin Market Cap vs. Weekly EMAs - Aug. 2012 to Present", fontsize=21) | |

| plt.show() |

Author

Author

Author

Switch data provider to Coinmetrics.io, add EMA 10, update formatting.

https://coinmetrics.io/data-downloads/

Author

Author

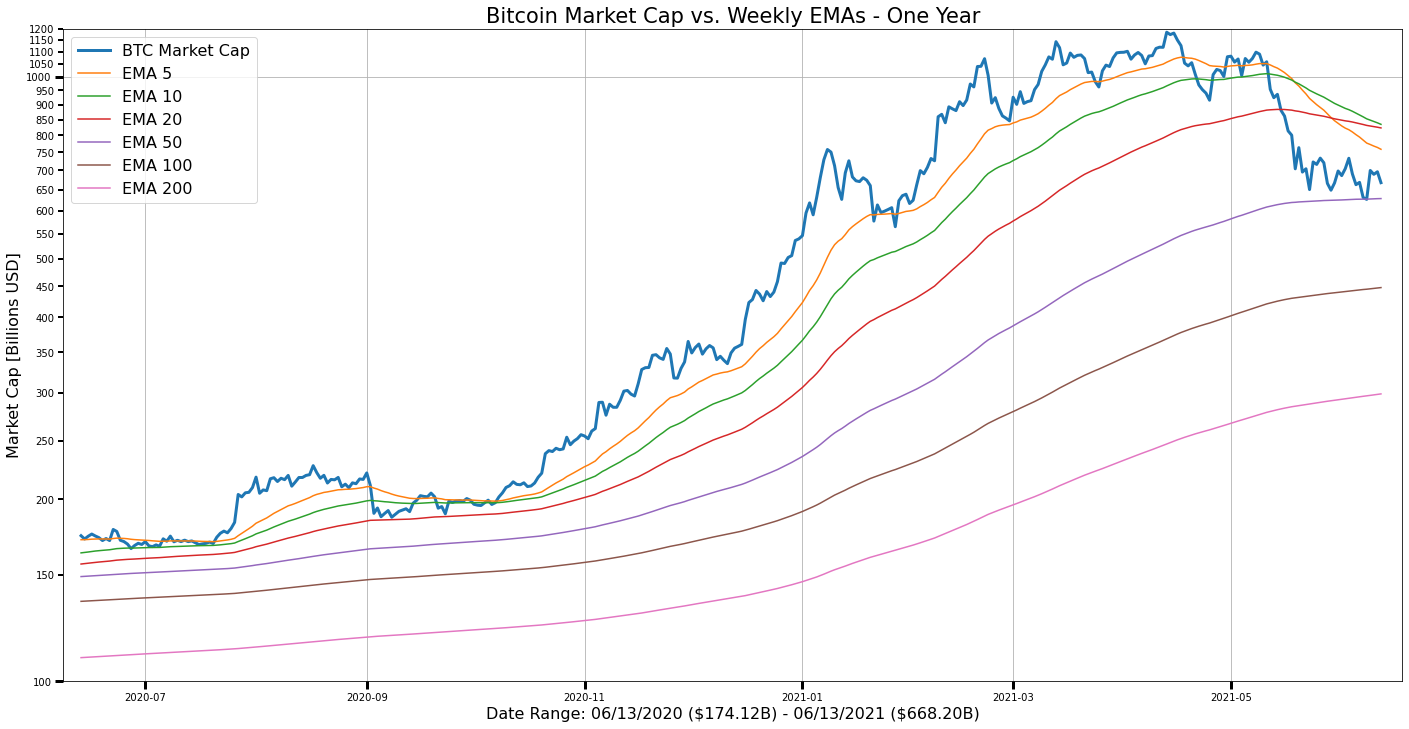

One year chart:

import datetime as dt

import requests

import io

import pandas as pd

import matplotlib.pyplot as plt

from matplotlib.pyplot import figure

from matplotlib import ticker

from matplotlib.ticker import (MultipleLocator, FormatStrFormatter, AutoMinorLocator)

%matplotlib inline

# Author: Adam Anderson, https://github.com/84adam

# Shout Out to: Benjamin Kircher, https://github.com/bkircher for help with formatting, data download

# function to download CSV file from URL; convert to Pandas DataFrame

def get_csv_from_url(url):

s = requests.get(url).content

df = pd.read_csv(io.StringIO(s.decode('utf-8')))

return df

if __name__ == '__main__':

# data source: coinmetrics.io - all BTC community data (CSV)

url = "https://coinmetrics.io/newdata/btc.csv"

# download data

print("Downloading data...")

df = get_csv_from_url(url)

# select columns

df = df[['date', 'CapMrktCurUSD']]

# rename columns

df = df.rename(columns={"CapMrktCurUSD": "market cap"})

# convert 'date' (object series) to timestamp format

df["date"] = df["date"].astype('datetime64[ns]')

# divide market cap by 1 billion

df['market cap'] = df['market cap'] / 1000000000

# rename for convenience

x = df['date']

y = df['market cap']

# calculate Exponential Moving Averages (EMAs) [Periods: 5, 10, 20, 50, 100, 200]

# enter (#-days) per period for EMAs, e.g. '7' = 1 week/period

per = 7 # one week

df['EMA_5p'] = df.iloc[:,1].ewm(span=(5*per),adjust=True).mean()

df['EMA_10p'] = df.iloc[:,1].ewm(span=(10*per),adjust=True).mean()

df['EMA_20p'] = df.iloc[:,1].ewm(span=(20*per),adjust=True).mean()

df['EMA_50p'] = df.iloc[:,1].ewm(span=(50*per),adjust=True).mean()

df['EMA_100p'] = df.iloc[:,1].ewm(span=(100*per),adjust=True).mean()

df['EMA_200p'] = df.iloc[:,1].ewm(span=(200*per),adjust=True).mean()

# rename for convenience

y5 = df['EMA_5p']

y20 = df['EMA_20p']

y10 = df['EMA_10p']

y50 = df['EMA_50p']

y100 = df['EMA_100p']

y200 = df['EMA_200p']

# set starting and ending dates

start = len(df['date']) - (365*1+1) # one year ago

# start = len(df['date']) - (365*2+1) # two years ago

# start = len(df['date']) - (365*3+1) # three years ago

# start = 1308 # market cap >= $100M from this date onwards: '2012-08-03'

end = len(x) - 1 # last date in series

start_date = df['date'][start]

end_date = df['date'][end]

# get start/end market cap values (Billions USD)

start_mc = y[start]

end_mc = y[end - 1]

# set ranges for plotting on chart

x = x[start:end]

y = y[start:end]

y5 = y5[start:end]

y10 = y10[start:end]

y20 = y20[start:end]

y50 = y50[start:end]

y100 = y100[start:end]

y200 = y200[start:end]

# set figure size

plt.figure(figsize=[24,12])

ax = plt.subplot(1, 1, 1)

# plot values in log scale

ax.semilogy(x, y, label='BTC Market Cap', linewidth=3)

ax.plot(x, y5, label='EMA 5')

ax.plot(x, y10, label='EMA 10')

ax.plot(x, y20, label='EMA 20')

ax.plot(x, y50, label='EMA 50')

ax.plot(x, y100, label='EMA 100')

ax.plot(x, y200, label='EMA 200')

# set y-scale limits: $100 million to $1.2 trillion

# ax.set_ylim(0.1, 550)

ax.set_ylim(100, 1200)

# set x-scale limits:

# start/end dates 10 days before/after specified `start_date`/`end_date`

# ax.set_xlim(start_date - dt.timedelta(days=10), end_date + dt.timedelta(days=10))

ax.set_xlim(start_date - dt.timedelta(days=5), end_date + dt.timedelta(days=5))

# set Y-axis tick formats

ax.yaxis.set_major_formatter(ticker.FormatStrFormatter('%.0f'))

ax.yaxis.set_minor_formatter(ticker.FormatStrFormatter('%.0f'))

ax.tick_params(which='major', width=3, length=8)

ax.tick_params(which='minor', width=2, length=5)

# for the minor ticks, show only every 100 billion mark

ax.yaxis.set_minor_locator(MultipleLocator(50))

plt.grid(True)

plt.legend(loc=2, fontsize=16)

plt.xlabel(f'Date Range: {start_date.strftime("%m/%d/%Y")} (\${start_mc:.2f}B) - {end_date.strftime("%m/%d/%Y")} (\${end_mc:.2f}B)', fontsize=16)

plt.ylabel('Market Cap [Billions USD]', fontsize=16)

plt.title("Bitcoin Market Cap vs. Weekly EMAs - One Year", fontsize=21)

plt.show()

Author

Sign up for free

to join this conversation on GitHub.

Already have an account?

Sign in to comment

My matplotlib skills are underdeveloped. How about Altair?