- Why Bitcoin?

- Not Too Late to Bitcoin

- Why Bitcoin and not Gold

- Why Bitcoin and not Real Estate

- Bitcoin Technical Summary

- Why Bitcoin Can't be Replaced by other Crypto "Alt Coins"

- Hardware Wallet

- Buy Bitcoin

- Bitcoin Block Explorer Sites

- Buy Giftcards Using Bitcoin

- Chainalysis

- TaxBit

- Security

- Ledn

- Run Your Own Node for Added Privacy

- Layer 2 Chains

- Learning Resources

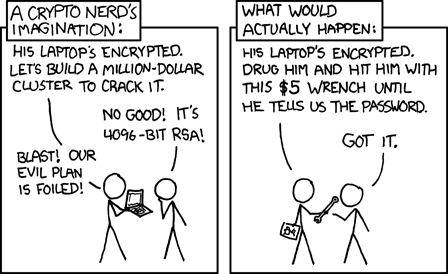

- The $5 Wrench Attack

- Technical Stuff

Central banks and Governments are stealing the value of your money every year.

They keep printing money and have devalued over 90% of the US dollar, UK pound sterling and every fiat currency. The Euro has lost 90% of its purchasing power in just 2 decades since introduction.

Every other asset in the world can be confiscated by governments, bitter exes, judges, civil lawsuits etc.

Think your assets, real estate or bank accounts can't be frozen or stolen?

Look at Abramovich when the Russia-Ukraine war broke out.

You are one ex-wife, ex-girlfriend, car crash, or other civil lawsuit away from having everything stolen from you by state force.

And that doesn't even include the growing talk of European "Re-migration" (a euphemistic word for mass deportations).

You're not too late, as Bitcoin is deflationary, which means it's scarcity can only go up, this beats even gold.

Bitcoin is often called "digital gold".

So why not just use regular old gold?

- gold is hard to verify (can you tell the purity or fakeness of a gold coin personally?)

- gold costs money to store

- gold is heavy and hard to move

- gold would be confiscated if you tried to take it through the airport

- gold is easy to steal

- gold is easy for authorities to confiscate (governments have done it before eg. US made it illegal in 1930s to hold gold)

- new sources can increase the gold supply inflation - asteroid mining in the not-so-distant-future will flood the market at some point in future

Bitcoin is better than gold and safer than gold.

Real estate can be confiscated, and heavily taxed.

As legacy democratic countries decline from unsustainable mass welfare state parasite voting, they'll become ever more desperate for taxes - real estate is a sitting duck for tax raids.

You cannot just put your real estate in your suitcase and leave.

You will face capital gains taxes and take a long time trying to sell real estate to get out.

Real estate is simply not a safe 21st Century portable asset in a politically destabilizing world of mass welfare state and mass welfare immigration.

- Cryptography secure

- Coins mined by solving complex cryptographic challenges

- Energy Intensive:

- the CPU difficulty protects it from attacks because even supercomputers cannot match the compute strength of the entire global Bitcoin network of high speed computers which use each specialized hardware for extreme performance

- World's Most Powerful Computer Network - 100x more powerful than all the supercomputers

- Bitcoin Network has never gone down in 15 years

- Network Effect:

- like a social network, getting everybody to move off it to something else is extremely difficult and would be slow

- people don't want to move because their peers aren't there - it's catch-22

Buy a hardware wallet for security.

See the Crypto page for a list of hardware wallets.

You may want to avoid buying Bitcoin on regulated Exchanges which have KYC (Know Your Customer) as this allows your Bitcoin holdings and transfers to be tracked by governments and other actors.

Do not leave your Bitcoin on exchanges.

The Exchange can steal your Bitcoin or go bankrupt like FTX, or the Government can seize it just like any bank account.

"Not Your Keys, Not Your Coins"

Avoid KYC interrogation bullshit, it's your money, you earnt it, you shouldn't have to answer questions about it.

Live free, don't answer to banks or governments about your own money.

Buying large amounts of Bitcoin is better done Over The Counter (OTC) if > $100k.

See your Bitcoin transaction in the ledger queue.

https://www.bitrefill.com/ae/en/

Analyzes the entire Bitcoin ledger to trace your Bitcoin holdings, transfers and cash outs etc.

Reports on Bitcoin ledger tracking and detects taxable events. They track clusters of wallets with transactions between them to figure out what's likely owned by you.

Tracks BTC addresses that have gone through centralized exchanges and are KYC'd. Easy to find you.

That's when Govs can come with OSINT, or bad actors can use Poisoned Nodes etc.

Make sure the BTC you receive isn't tainted - it hasn't gone through some darknet market place or a hack.

Borrow Against Your Bitcoin instead of selling it.

You have to send your BTC to them as collateral.

High interest rate though.

- Lighting Network

- Liquid Network by Blockstream

https://www.lopp.net/bitcoin-information.html