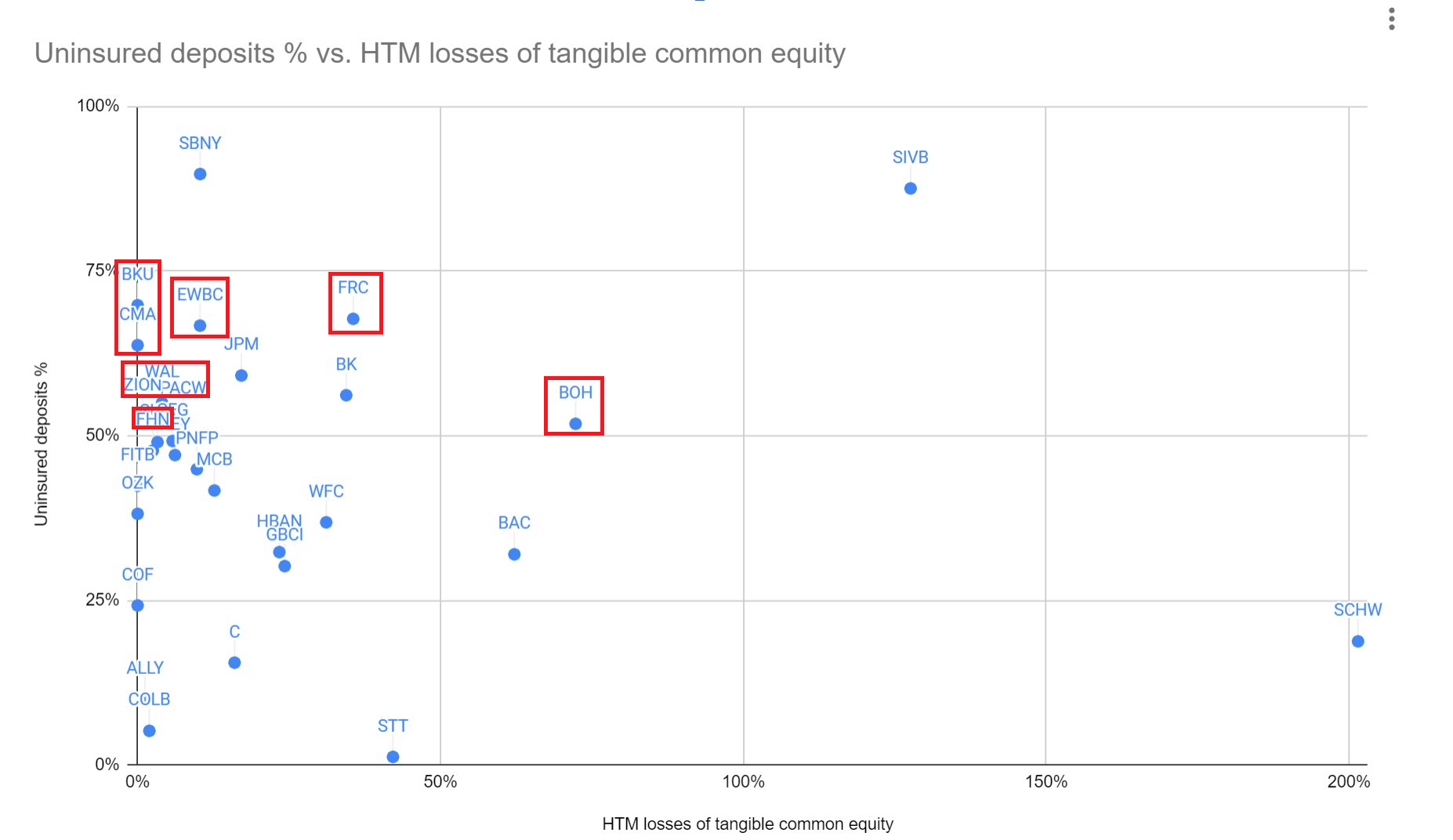

Let's suppose the Federal Reserve were to make loans to cover the uninsured deposits of these nine banks, each of which have a market cap below $10B.

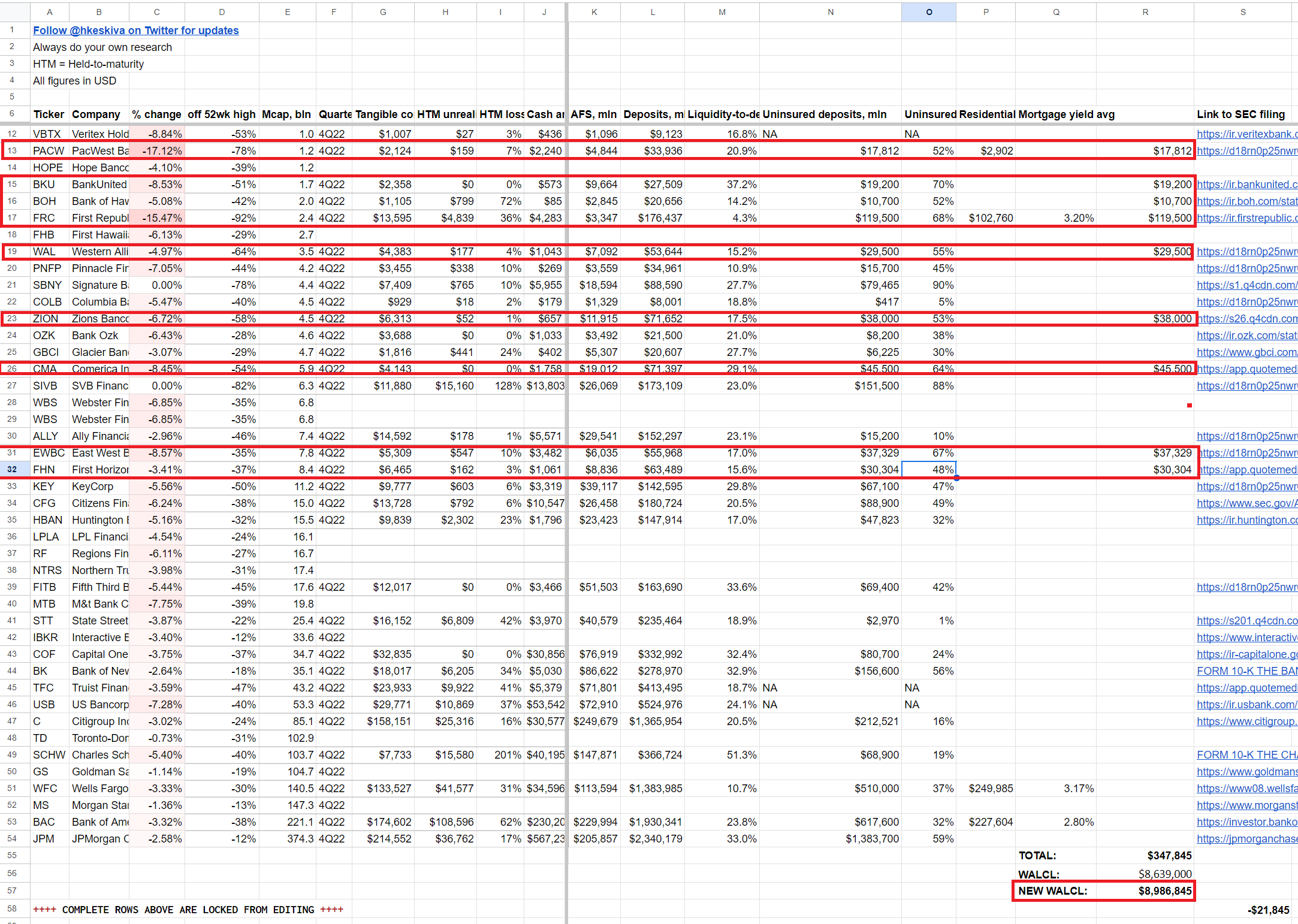

The uninsured deposits for these comes out to $347B:

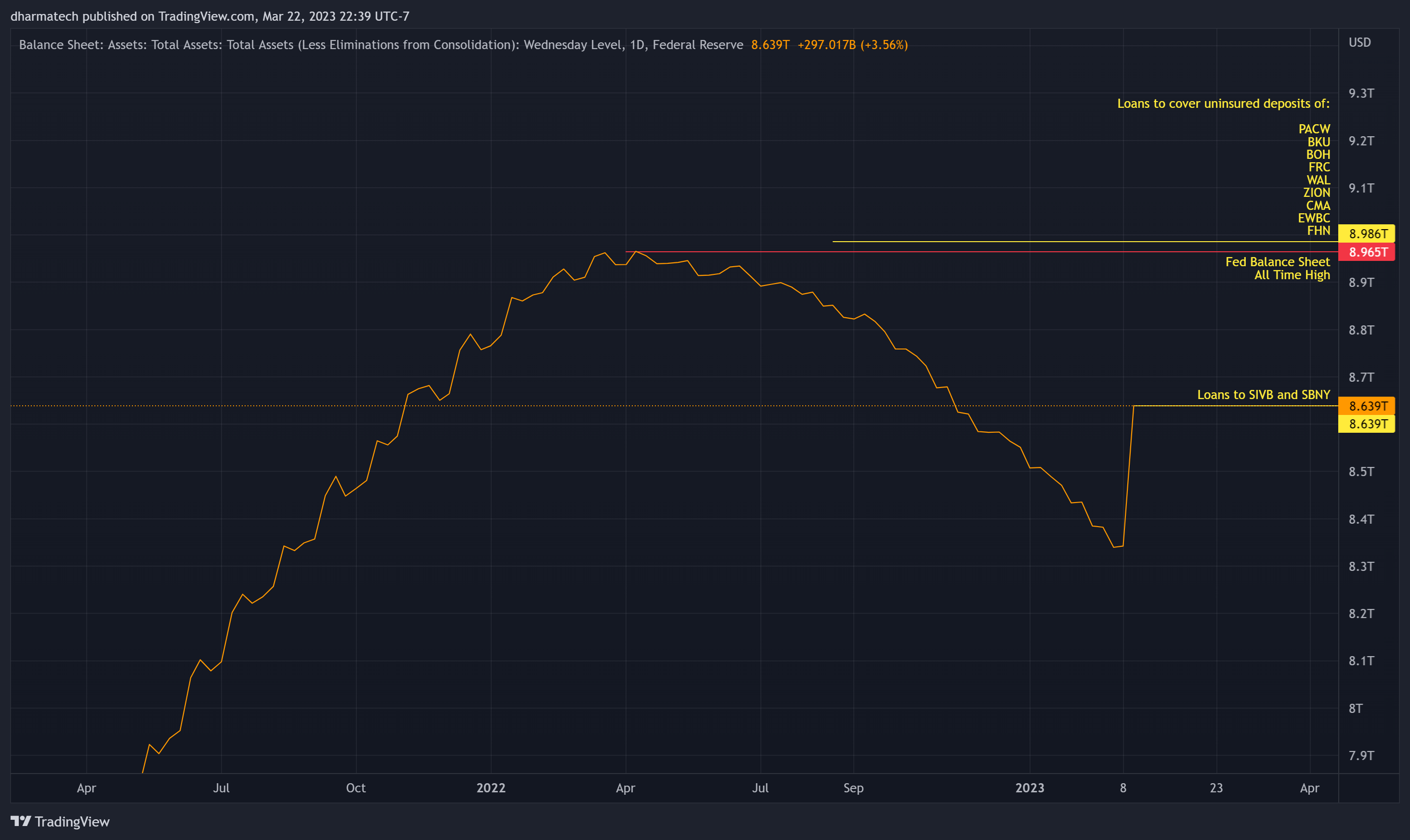

This would raise the Fed balance sheet to $8.986T, which is greater than the all time high of $8.965T:

Important note: the above values for uninsured deposits were taken from the following spreadsheet:

https://docs.google.com/spreadsheets/d/1dROQQuJmoLbrNgkM3ZYiuvVzj3dfRw2LESsIP7t5u5c/edit#gid=0

These values are from the 2022 10K reports. They may very well have been reduced since then in some cases (see for example, PACW).

This is something to think about when you see folks demand that the Federal reserve back all uninsured deposits for all banks.

The above is what happens when you only cover nine small banks.